what is a limited pay whole life policy

A limited whole life insurance policy builds a cash reserve even faster that a standard whole life insurance policy due to the accelerated payment plan. Limited pay life 10 15 20 year.

Life Insurance Health Plans In Oregon Get A Quote Today

Whole Life Insurance Policy.

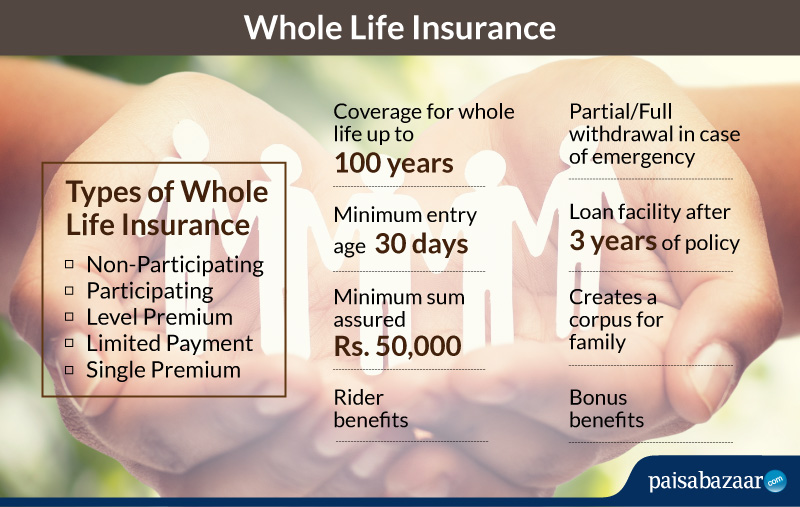

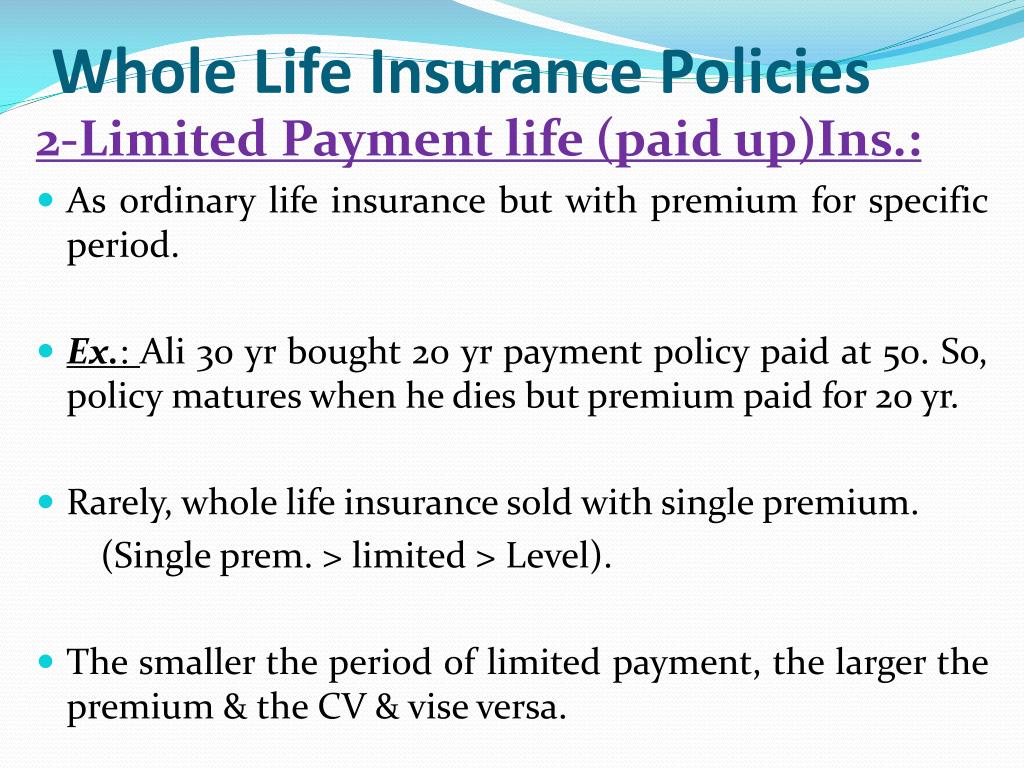

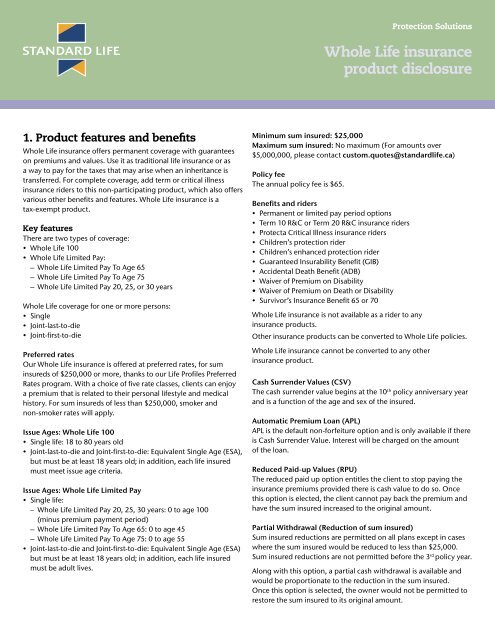

. Whole life insurance is a contract with premiums that includes insurance and investment components. Unlike regular whole life insurance the beneficiary pays premiums over a shorter time instead of their entire lifetime. For most whole life.

Because higher premiums are paid each. If youre close to retirement age and are shopping for affordable life insurance a limited-pay life policy may be the best fit for you. Limited payment whole life insurance covers you for life.

A limited pay life insurance policy provides lifelong coverage without a lifelong. Limited pay whole life insurance is a type of permanent life insurance policy that is designed to pay all premiums on a predetermined schedule rather than annual payments for. When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition.

Benefits of 10 Pay Life 2022 Whole Life Insurance. Limited pay life insurance is a type of whole life insurance with a much shorter guaranteed payment period than a usual whole life policy. As long as premiums are paid.

What is a limited-pay life insurance policy. There are several types of. You get death benefits and lump-sum cash that accumulates during the policy period.

Limited-pay life insurance is for individuals looking to pay for the total cost of their whole life insurance policy within a set amount of time. A whole life policy generally requires premium payments for. There are Twenty Year Limited Pay Whole Life policies whereby the death benefit if forever but only 20 annual payments need be made.

The 20 pay option is an interesting. A limited pay life policy is a type of whole life insurance. A limited-pay life policy is a type of whole life insurance policy that you can pay off in advance.

These policies can be completely paid for in 10 15 or 20 years. There are several types of limited pay life. You have a couple of options when.

Premiums are usually paid over a period of 10 to 20. With a limited payment whole life policy you pay for the entire life insurance policy during the first years only. So the face value of a 10000 policy is 10000.

A limited pay insurance policy is a type of permanent life insurance product sometimes called whole life in which the policyholder pays premiums over a set period of time or until a specific. If purchased early enough in life theyll help you avoid. You can purchase a whole life.

What is the cash value of a 10000 life insurance policy. The insurance component pays a. This is usually the same amount as the death benefitCash Value.

With a 7-pay whole life policy you pay for the policy for 7 years and then its paid up. Limited pay life insurance is a type of whole life insurance that has a shorter guaranteed payment period than a traditional whole life policy. The policy is designed to be paid up after 10 level annual premium payments.

This policy is a better option for people who want to access their cash value in the future.

How Long Does The Coverage Normally Remain On A Limited Pay Life Policy Whole Vs Term Life

What Is Limited Pay Life Insurance Policyadvisor

Whole Life Insurance Insurance Pro Florida

Whole Life Insurance Check Compare Whole Life Insurance Online

Solved Suppose You Are A Life Insurance Broker With A Client Chegg Com

Limited Pay Whole Life Insurance Choosing A Policy Paradigmlife Net Blog

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Are Limited Pay Life Insurance Policies Ideal

Comprehensive Guide For Buying A Limited Pay Life Policy

Ppt Chapter 2 Life Insurance Policies Whole Life Insurance Powerpoint Presentation Id 1988231

Whole Life Insurance Definition How It Works With Examples

Calameo What Is Whole Life Insurance

Chapter 16 Fundamentals Of Life Insurance Ppt Download

Whole Life Insurance Product Disclosure 6326

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Is A Limited Pay Life Policy Clearsurance

Limited Pay Whole Life Series 200 Illinois Mutual